Substantive procedures assessed auditors misstatement transaction disclosure Substantive procedures testing plant property equipment audit Substantive testing accounts balance

Tests of Details: Substantive Procedures | CPA Hall Talk

Substantive procedures audit tdz Substantive procedures for property plant and equipment Substantive tests audit cash sales accounts presentation common receivable risk control balances receivables confirm ppt powerpoint chapter

Substantive procedures tests audit

Substantive testsSubstantive testing audit auditor question ppe side solved expert answer Substantive testing: an introductionSubstantive testing.

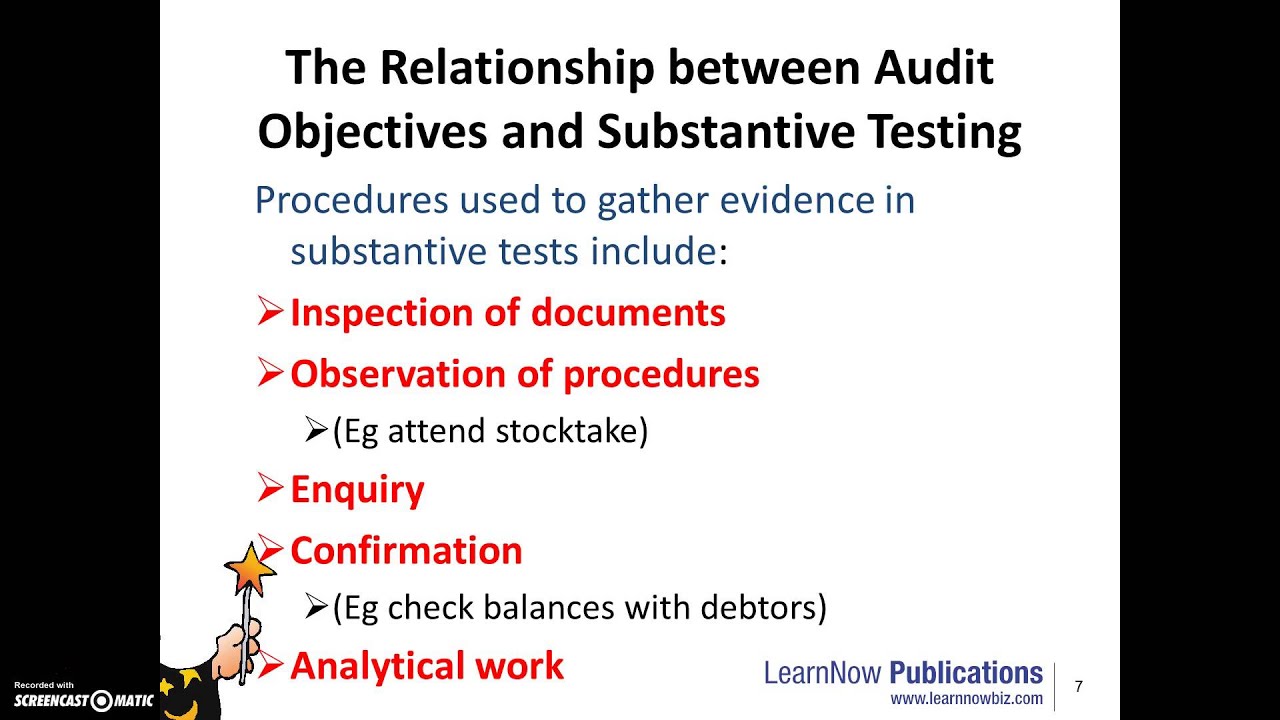

Sa 330 auditor’s responses to assessed riskSubstantive tests procedures must underlying balances valid materially misstatements classes transaction material account complete contain any they not Substantive procedures auditing test of control the auditorProcedures substantive auditor auditing.

Substantive testing procedures assertions account balances period accounting online bookkeeping adam oct hill decisions

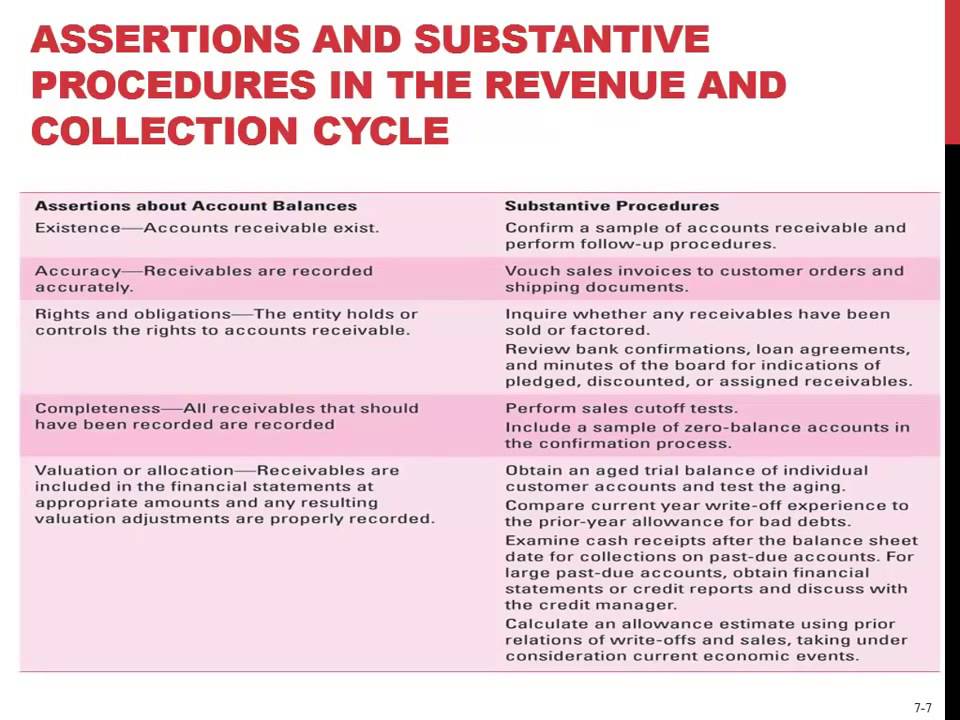

Substantive cash balances tests audit presentation ppt powerpoint chapterControls testing vs. substantive testing: what's the difference? Procedures revenue substantive assertions cycle collectionLesson 22: substantive audit procedures.

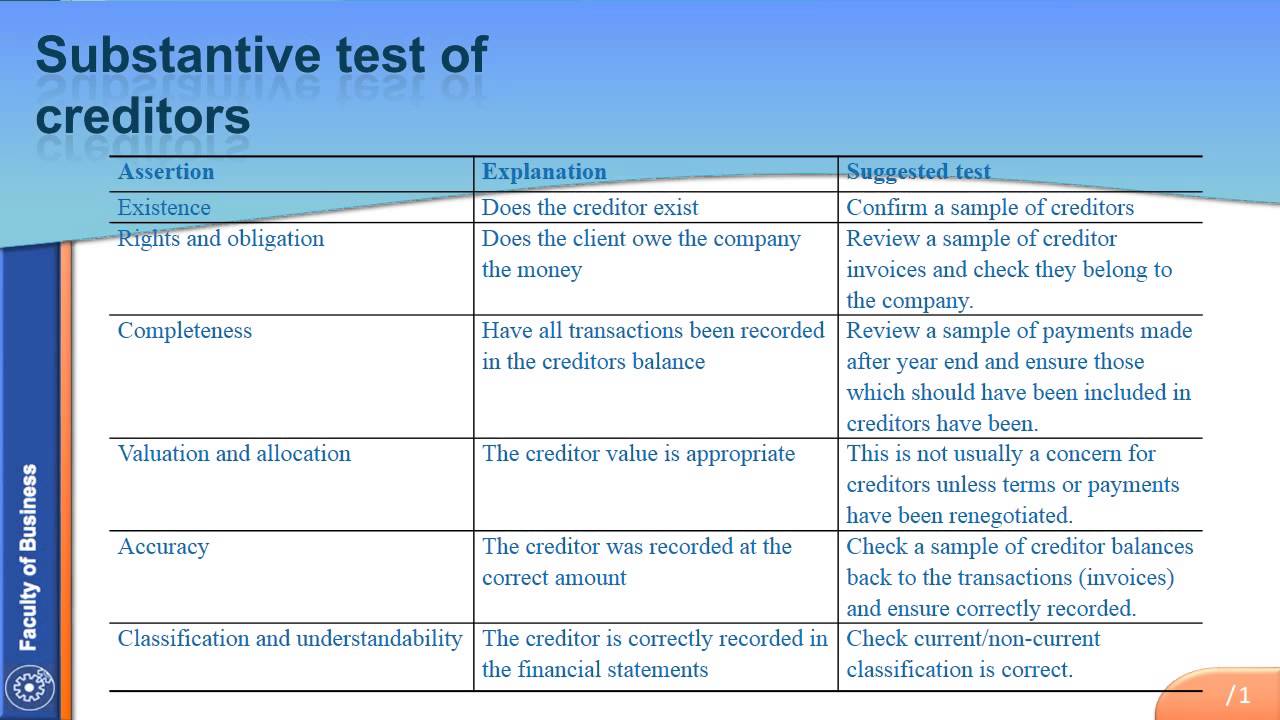

Substantive testingSubstantive audit test ppt powerpoint presentation testing Tests of details: substantive proceduresSubstantive test of creditors.

Assertions & substantive procedures in the revenue & collection cycle

Substantive audit tests accounts receivables cash balances receivable control ppt powerpoint presentation chapterProcedures audit substantive analytical types details risk ppt powerpoint presentation evidence Substantive vs controls testingSubstantive testing.

Substantive testSolved question 1 – substantive testing part a when the .

Substantive testing - Online Accounting

PPT - Substantive Audit Tests for Cash Balances PowerPoint Presentation

Substantive test of creditors - YouTube

Substantive Procedures for Property Plant and Equipment | Depreciation

Substantive Testing: An introduction - YouTube

Substantive Tests

Topic 9 - Substantive testing of balance sheet accounts - YouTube

PPT - Substantive Audit Tests for Cash Balances PowerPoint Presentation

Assertions & Substantive Procedures in the Revenue & Collection Cycle